Bitcoin and other cryptocurrencies like Ethereum are traded online 24/7. The Bitcoin market never sleeps. However, trading cryptocurrency is slightly different than trading forex, futures, or stocks.

World's biggest crypto exchange in trading volume. All forms of payment accepted. Trading fees are only 0.1% | |||

The most popular exchange in the USA, based in California. All forms of payment accepted. Trading fees are 1.49% | |||

The most secure cryptocurrency exchange in the world. Based in the US and running on a blockchain. Trading fees are 0.2% |

Trading Bitcoin vs. Investing

Are you interested in Bitcoin trading or investing? There are many online and offline sources that refer to trading and investing as if it was the same thing, but these two are actually very different, especially when it comes to Bitcoin. For further reference, it’s very important to understand this difference.

Bitcoin Trading Online

Bitcoin trading refers to active market speculation on the price of the asset. Bitcoin traders can generate profit when the price goes up and/or when the price goes down. They can trade either way and still come out in profit if their market prediction is correct.

Similar to trading Forex pairs, indices, or stocks, Bitcoin traders use analysis to predict the movement of the asset in hope of making a profit on the price fluctuations. Ultimately, Bitcoin traders have two choices, to buy the asset or to sell it.

When they are buying Bitcoin, the aim is to buy it at a dip, when their analysis indicates that the price is currently at a low, and to sell it when the price is higher.

When they are selling, the aim is to sell when the price is high, when their analysis signals that Bitcoin is currently overpriced, and to exit their trade when the price goes down.

Bitcoin trading can involve trades that last a month, a week, a day, an hour, or even a few minutes. This depends entirely on the trader’s analysis and judgment, as well as, trading experience, preferences and individual trade setup.

In addition to Bitcoin technical and financial analysis, active traders also need to posses other equally important skills, such as risk management, trading platform operation, timing, and trading psychology. However, they don’t necessarily need Bitcoins.

It is entirely possible to trade Bitcoin and profit from its price fluctuations without actually holding any Bitcoins at all.

Bitcoin Investing

Investing in Bitcoin is not the same thing as Bitcoin trading. Generally, when you are an investor you buy an asset and hold it, usually for at least a year. Most investments range between 5 to 20 years.

The case of Bitcoin shows that long term investing can be very profitable. So much in fact, that a new term – HODL is often used by Bitcoin enthusiasts to refer to holding the asset no matter what the markets are doing.

Bitcoin investors are concerned more with the potential and long term results of their investments, than temporary price fluctuations and speculations. As a result, Bitcoin investors do not actively trade the asset, instead they simply own the asset.

In addition to holding Bitcoins in their portfolio, investors can also choose to invest in other Bitcoin related activities, such as mining.

Buying Bitcoins safely

Buying Bitcoins today is a lot easier and safer than in 2009. There are many secure online providers that facilitate Bitcoin purchases.

As for payments, there are many options available, but generally credit card transactions tend to have the highest fees, ranging from 5-10% of the purchased amount.

Wire transfers usually have the lowest transaction fees but may take a few days to complete.

Note that if you intend to invest in Bitcoins, also invest in a secure offline wallet, which will generate your private address. You can then set this unique Bitcoin address as your receiving address when you make the purchase.

If that is not possible and your purchased Bitcoins will be delivered to your unique wallet in the seller’s system instead, transfer your coins to your secure offline wallet after the transaction is completed.

Buying Bitcoins with credit or debit cards

Buying Bitcoins with a credit card is fast, secure, and very convenient, however, it is also more expensive than other options. Bitcoin delivery usually takes only about 5 to 15 minutes after confirmation.

As expected, there are more security measures taken against card purchases. On all platforms new users are only able to purchase Bitcoins worth about $50-$100 with credit or debit card.

Upon verification those limits are increased to accommodate larger transactions in the future.

Few places where Bitcoin can be purchased with a credit card/debit card.

CoinMama – One of the most popular online services for instant Bitcoin transactions with Visa or Mastercard. Purchases can be made in USD or EURO. Accepts US clients. Transaction fees are about 10%.

CoinBase – Their platform has been around since 2012. It offers a quick way to buy Bitcoin, Ethereum, and Litecoin with Visa, Mastercard or a Debit card. Transaction fees are about 4%, but bank transfers are free and SEPA cost only a few cents.

IndaCoin – Platform for Bitcoin and Ethereum buyers from over 100 different countries. Credit card transactions are available in Euro, US dollar, and Ruble. Indacoin can immediately accept user’s Bitcoin address or create a new wallet. Transaction fees are about 4.3%. Currently, there is no option to buy via bank transfer.

Other buying options

Today, Bitcoin can also be easily purchased with bank transfer, Paypal, Skrill, Western Union, and other payment processor.

LocalBitcoins – One of the earliest open marketplaces for people to trade Bitcoins locally using a wide variety of payment methods. It’s advisable to buy only from users with very good feedback and many transactions in the past.

Online trading platforms for Bitcoin

Every trader needs a good trading platform. That’s where it all begins. In order to trade well and to perform technical analysis on Bitcoin you need to see accurate price action, have access to various analytical tools, and be able to take positions swiftly. Here are the most popular trading platforms.

Whaleclub (not just for the whales)

One of the best online Bitcoin trading platforms is by Whaleclub. They use TradingView software for price action analysis which is fast, secure and very accurate. If you traded Forex using MT4/MT5 or ThinkorSwim trading software, you shouldn’t have any problems. Its user interface is very simple and self-explanatory.

The popularity of Whaleclub speaks for itself, with a total daily trading volume surpassing 20 million US dollars. In addition to being able to trade Bitcoin, Etherum, Litecoin, Dash, and Ripple you can also trade Forex pairs, commodities, indices, stocks, and bonds. Deposits and withdrawals can be made in Bitcoin or Dash. There is also an active chat window where online traders can share ideas and help each other.

The trading platform offers great speed and functionality. There are hundreds of analytical tools available and all technical analysis done on the charts can be easily saved for future reference. Visit Whaleclub

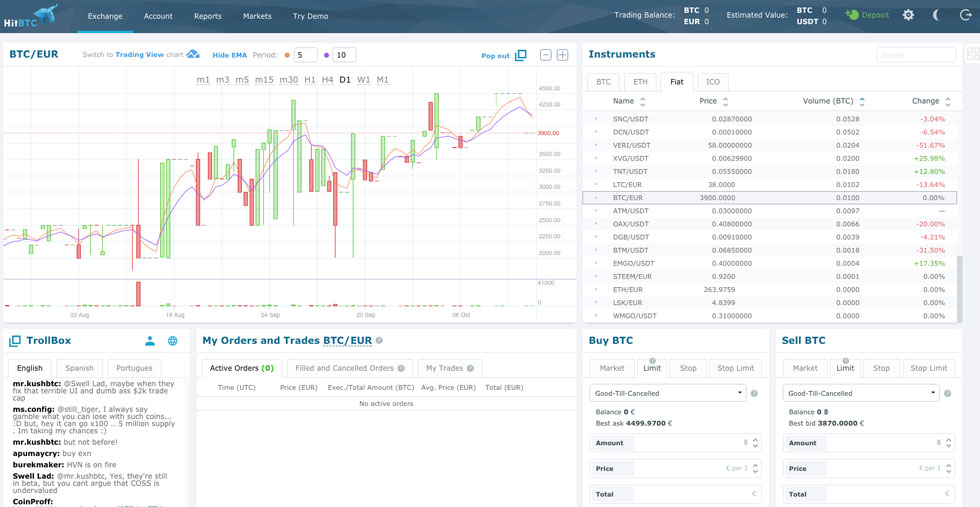

HitBTC (Cryptos rule the world)

HitBTC is fully dedicated to traders of cryptocurrencies as it has one of the most advanced online exchanges. It features an amazing number of available established coins and also ICO coins and tokens which are ready to be traded online. Their trading platform is ideal for someone who wants to trade Bitcoin against other cryptocurrencies.

There are no fees for crypto deposits and very low network fees for withdrawals. Trading fees for immediate orders are low, set at 0.1% of trade amount. This goes for the support and operational costs of the exchange.

The Hit BTC trading platform has been in operation since 2013. Initially built by software developers and professional traders with a venture investment of 6 million USD, the platform offers unique features and a safe and stable trading environment. Visit HitBTC platform or Read the review

Live Bitcoin Price Chart

You can also use the Bitcoin Live Chart featured on our site to follow the price action of Bitcoin and to perform technical analysis. However, you will not be able to trade actively, ie. buy or sell. In order to do that you will need to sign up with one of the Bitcoin trading platforms mentioned above or use an exchange.

Fundamental & Technical analysis of Bitcoin

Bitcoin is traded like any other financial asset. Traders use fundamental and technical analysis to predict its future price levels and take positions accordingly.

Technical Analysis

A few years ago, back in 2009, there wasn’t a lot of historical data available for cryptocurrency which made it more difficult to rely on technical analysis alone. As the markets tried to adapt to Bitcoin, its price was very unstable.

Trading Bitcoin today using technical analysis is completely different as there are many more traders involved and there is a lot more volume in the markets. With the liquidity of crypto assets increasing and more historical data available, technical analysis is now used by most Bitcoin day traders.

Among the many tools available to a trader, the most common technical tools used for Bitcoin analysis are Moving Averages, Fibonacci levels, Support and Resistance, and Volumes. Each tool gives the analyst more insight into the behavior and movement of the price of Bitcoin.

Fundamental Analysis

Fundamental analysis of Bitcoin, on the other hand, is mostly based on economic data releases, market reports, financials, statistics, and news. In the case of Bitcoin, this can range from news and information about its technology, government regulation, user acceptance, and market demand.

Please see Additional resources section for links to information that will help with fundamental analysis.

There are many examples when the price of Bitcoin was influenced by government actions or slandering press publications. For example, when the Chinese government threatened to close Bitcoin exchanges in China the price of the asset fell considerably.

On few occasions, when press echoed the words of ‘someone important’ that Bitcoin is a fraud or a bubble, the impact on the price could also be noticeable.

Today the price of Bitcoin seems much more resilient to attacks from individual entities, especially those representing mainstream banking, which has a lot to lose from a widespread distribution of the coin.

Which analytical method is best for Bitcoin?

Using technical analysis coupled with fundamental analysis is usually recommended by serious Bitcoin traders. The reason is that the probability is greater when both analytical methods – technical and fundamental, indicate the same thing.

For example, if your trading chart suggests that the price of Bitcoin is likely to go up, and your fundamental analysis also suggests an impending increase in price, the probability of that actually happening will be much higher.

There are many traders who solely rely on technical analysis, claiming that everything is priced in and reflected in the market price. While this, in theory, is true, fundamental analysis of Bitcoin can still be very useful to a trader.

Why some traders choose Bitcoin

There are many reasons why existing traders are turning to Bitcoin trading. Here are some of the main arguments:

- The volatility of Bitcoin makes it more attractive to active traders because more money can be made in a shorter time span than trading the EURUSD pair, for example.

- Dedicated Bitcoin trading platforms have lower operating costs.

- It’s easy to focus on and to follow a single asset, such as Bitcoin.

- On most platforms, Bitcoin withdrawals are completely free and there is no minimum amount requirement.

- Withdraw funds to a private wallet.

Trading Bitcoin with a margin

There are few brokers and trading platforms where Bitcoin margin trading is allowed. As in Forex, margin trading simply allows to trade with borrowed capital and increase exposure without having to actually have the funds in the account.

The most common margins for Bitcoin are set at 1:2 or 1:3, which are quite low, however this varies from platform to platform and can also be increased on individual basis depending on trader’s existing trading capital and experience.

Trading on margin can increase profits as more amount is actually put on each trade, but it can also increase the amount of losses. Therefore, margin trading is usually only recommended to advanced traders.

Protecting your Bitcoin capital and investment

The most important thing to consider when dealing with Bitcoin is its storage and security of transactions.

All Bitcoin exchanges will offer online wallets where you can store your Bitcoins and other cryptocurrencies online. Some exchanges will offer an option to move unused funds into an offline wallet. Although this is much more secure, your Bitcoins will still remain with the exchange and you have no guarantees that their offline storage is not / or will not be compromised.

To fully secure your winnings and unused trading capital you will need to move your Bitcoins to your own offline wallet. The key word here is offline. You can think of an offline wallet as your own private bank, which only you can access.

Online wallets are simply not secure enough for today’s hacking tools and talents, so please do not hold large amounts of money in your online wallets. The best way to store your Bitcoins is by using a paper offline wallet or a hardware wallet.

Offline paper wallet is very secure but it is quite inconvenient for transactions. Hardware wallets have excellent encryption and can be used securely even on an infected and hacked computer. They are also much more practical than paper wallets. Here are the most trusted hardware wallets.

Ledger Hardware Wallet (affordable and effective)

One of the most popular hardware wallets is made by Ledger, a French company that operates in Paris, Vierzon, and San Francisco.

Ledger has various hardware wallets but Ledger Nano S is by far the most widely sold. It is a very secure Bitcoin wallet that generates the entire seed offline (seed is the password to your Bitcoin account) and has an 8-number PIN protection and additional PASSWORD and 2FA protection for extra layers of security.

Ledger Nano S connects to the computer using a USB cable and works with an interface provided by Ledger apps. The specific Ledger app can run as your browser extension or a separate application installed on your computer.

The great thing about Ledger Nano S is its capability to store other cryptocurrencies, such as Bitcoin Cash, Litecoin, Etherum, Ether Classic, Ripple, Stratis, and other.

The reason for its widespread popularity is its very low price in relation to its high-security levels, solid built, and additional features. Visit Ledger

Trezor hardware wallet (the first of its kind)

One of the first and most secure hardware wallets available on the market, and still loved by many Bitcoin owners, is Trezor.

As with the Ledger wallet described above, the wallet seed is generated completely offline, minimising the risk of anyone being able to see and copy it except for the wallet owner.

Trezor hardware wallet also offers a password manager and 2-Factor Authentification for additional layers of security. Every outgoing transaction needs to be manually approved on the Trezor.

Trezor wallet can store other cryptocurrencies such as Bitcoin Cash, Etherum, Zcash, Litecoin and Dash. It can also store any ERC-20 tokens.

In addition, the wallet’s inbuilt cryptography protection can be utilized to protect your email messages, logins, or server access via safe ssh access.

For a long time, the Trezor wallet was considered as one of the most secure hardware wallets to store Bitcoins. Even though there are some great alternatives offered by other companies, the Trezor wallet remains as one of the safest and most secure devices for Bitcoin owners. Visit Trezor

Latest blog posts

References and useful resources

- Bitcoin Blockchain information in real-time, allows users to explore the entire blockchain and see other related information.

- Bitcoin Talk is one of the largest online forums dedicated to Bitcoin.

- Wikipedia page about Bitcoin including its history, design, economics, and legal status.

- Bitcoin Markets and Bitcoin chat rooms on Reddit, often include insightful updates and comments by experienced users.

I will like to try my hand on Bitcoin Trading