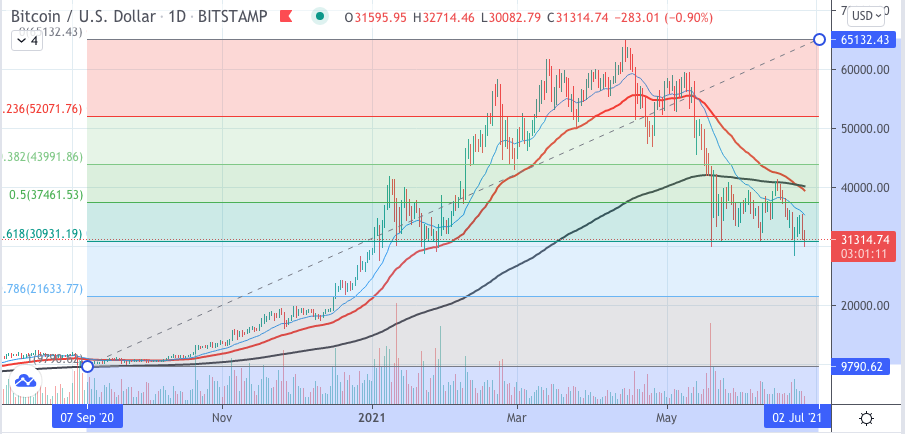

As expected by many technical analysts the 200 MA has crossed below the 50 MA on a Daily chart, which confirms the Death Cross signalling the possibility of the beginning of a bear market.

At the time of writing this analysis, BTC is testing again it’s major support level between $29,000 and $30,000. As mentioned in the previous analysis this is a very strong support level which will be tough to break by the bears.

This particular support level coincides not only with Support/Resistance trendlines on a Daily and Weekly charts, but also with the strong 0.618 Fibonacci level, as seen in the chart above.

In addition, there was large institutional entry into the market at that level, so it will be fiercely defended by investors with a lot of capital. They will be inclined to stock up more Bitcoin at those levels, possibly pushing the price higher.

Here is a Weekly chart of BTCUSD showing the main area of strong support. We can see that the $30,000 area had a very bullish momentum in the beginning of the year. We are now back to those accumulation levels.

Even though this may seem like a good set up to short Bitcoin, as many traders expect the price to go much lower, it’s advised to wait until this this Support level is actually broken and confirmed by a closed candle.