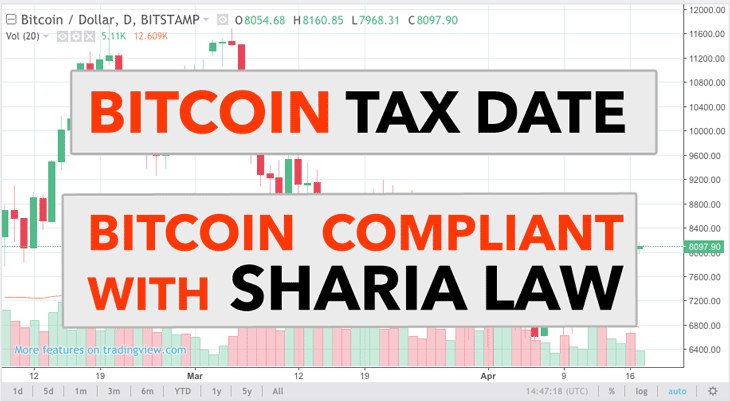

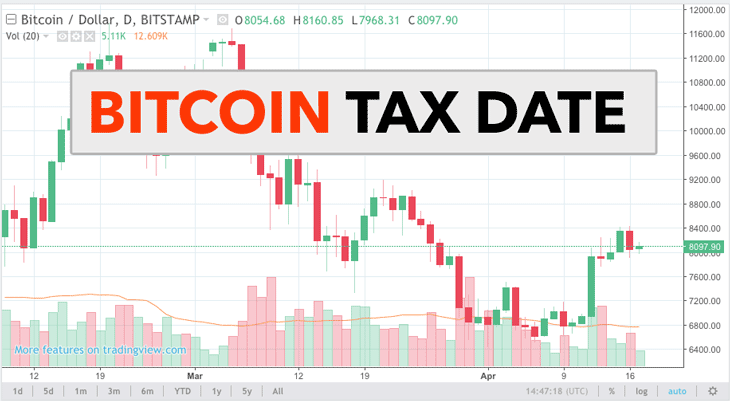

Bitcoin has certainly made an impact in the last couple of months and all cryptocurrencies have seen some amazing highs and lows. The price of Bitcoin has fallen quite substantially to $6,000 from $20,000 and is now trading near $8,000.

There were many factors that contributed to Bitcoin’s major fall, but putting all of that aside, one could argue that this is a healthy pullback that is a common occurrence in financial markets. Yes, even corrections of 80% are quite common.

Bitcoin is not dead, as some may claim. It will stick around, despite that there may be other cryptocurrencies that seem better suited for the crypto revolution than Bitcoin, for example Ethereum (now trading near $500).

So why has Bitcoin not fallen completely and is now recovering. Could we possibly have another bull run on the horizon?

BTCUSD tested it’s bottom and the bears could only push the price down as far as $6,000 before bulls taking charge again.

Everyone has to pay their taxes, no exceptions

There were numerous suggestions by analysts that Bitcoin traders and investors were liquidating some of their positions to cover their tax bills.

In the USA, the final tax date in 2018 is April 17.

Analysts suggest that the price of Bitcoin might start going up past this date, as other investors with capital will try to enter the market when prices are lower.

Bitcoin is now permissible under Sharia Law

Another development that pushed the BTCUSD prices higher from their extreme lows was a publication by an important Islamic scholar which indicated that Bitcoin is permissible under Sharia Law. The publication was a study on whether Bitcoin is Halah or Haram.

This announcement opened up Bitcoin investments to near 1.6 billion Muslims.

Bitcoin price moved $1000 higher soon after the publication was released. Many analysts attributed this sudden spike in price to Bitcoin’s confirmed Sharia Law compliance.

Bitcoin ETFs could get the green light

Also last week, it was revealed that the SEC (Securities and Exchange Commission) is now reconsidering it’s initial position and wants to change its rules to allow Bitcoin ETFs (Exchange Traded Funds) to be listed on NY exchanges.

Once the rule change is in place and is favourable, it could have a huge ripple effect that could push the price of Bitcoin to $25,000 by the end of this year, as some Bitcoin analysts have claimed earlier this year.